Fundamental to economic analysis is the assumption that a condition of equilibrium exists with respect to key economic variables. That is, the value of these variables find a position of rest rather than constant fluctuation and volatility. Common examples include different models of market behavior known as Supply and Demand analysis.

In these models of the market, we define the behavior of sellers based on the goal of profit maximization in the production and/or sale of a particular good. Higher selling prices allow a trader/seller to reap a gain over and above the price initially paid for a final good or asset. In the case of business firms, the production of additional units of a particular good involve increasing opportunity costs in drawing resource inputs away from other productive uses. Higher prices are necessary to cover these increasing costs of production. Thus, these types of behaviors on the selling side of the market typically lead to a positive relationship between market price (the dependent variable) and quantity supplied (the independent variable).

Separately, we define the behavior of buyers based on the goal of maximizing the utility gained from the purchase and consumption of this same good. As prices fall, holding income constant, the buyer finds that his/her purchasing power has increased allowing for buying greater quantities of a particular good. It is also the case that, for the consumer, additional quantities of a good consumed provide less additional satisfaction relative to previous units consumed. This notion known as diminishing marginal utility implies that the consumer is willing to pay less for these additional units as it becomes more efficient to use his/her income for the purchase of other goods. For the buyer, these types of behaviors typically lead to a negative relationship between the market price (dependent variable) and quantity demanded (another independent variable).

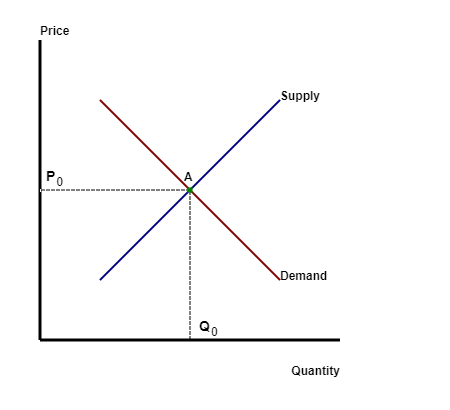

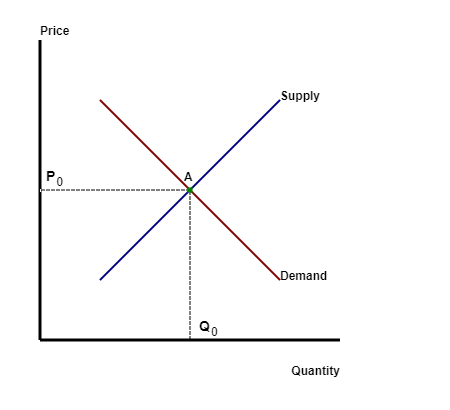

These relationships are demonstrated in the diagram in Figure 1.

In these models, we assume that one unique price exists such that the Quantity Supplied by sellers is exactly equal to the Quantity Demanded by buyers. This unique price P0 is defined to be the equilibrium price.

The Supply and Demand framework represents an analytic tool that assists in the understanding of how markets operate. Each curve represents the separate behavior of the sellers (Supply) and the behavior of buyers (Demand) in a particular market.

This notion of Equilibrium tends to be a rather strong assumption in these economic models.

In the physical world we often observe equilibrium conditions or situations resulting from the influence of physical laws. For example: a piece of chalk resting on a table is in equilibrium. This situation is the result of the effects of gravity and the existence of a flat and level surface. Gravity helps to maintain and even restore this equilibrium condition if this position of rest is disturbed.

In our market models, we need to ask is: where does the gravity come from to establish and maintain an equilibrium price? The answer is in the reaction of sellers and buyers to disturbances in the market.

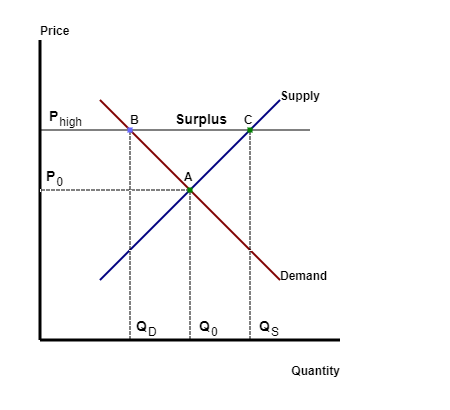

For example, it could be the case that the market price has been forced above equilibrium such that supply decisions by producers with respect to output exceed the amount demanded by consumers. In this case a surplus is the result. This surplus is often first recognized by the sellers through the accumulation of inventories.

These sellers would react by cutting the price of their product relative to competing sellers (price-cutting is how sellers compete) and by reducing the rate of production. Buyers would react to the presence of lower prices by increasing their rate of consumption. This process would be expected to continue until the excess inventories have been eliminated.

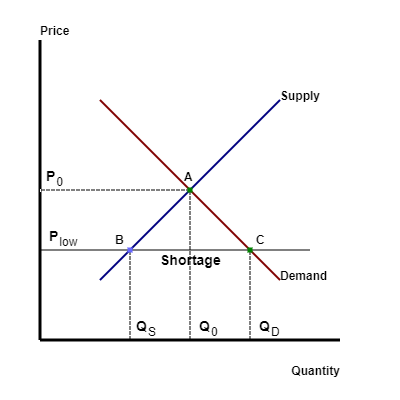

If the market price differed from the equilibrium price such that the quantity demanded exceeded the quantity supplied, a different disequilibrium condition known as a shortage would result. Often, but not always, shortages are first recognized by buyers in the form of empty shelves, queuing, and general difficulty in making a desired purchase.

These consumers react by bidding prices up in competition with other buyers (bidding is how buyers compete) much like an auction for a single piece of art. As these prices are bid upwards, some buyers drop out of the market reducing the overall rate of consumption. Sellers react to the presence of higher prices by allocating resource inputs from other uses towards production of this particular good.

Thus in our models of the market place, Competition provides the gravity to maintain or restore the equilibrium price. If surpluses exist, competition among sellers force prices downwards. If shortages exist, competition among buyers force prices upwards. The occurence of these surpluses or shortages lead to changes in relative prices signalling a need for a reallocation of resources.

In reality, surpluses and shortages are caused by changes or shifts in either the demand or supply functions. These shifts are the result of shocks to other (exogenous) variables that affect supply decisions by producers or demand decisions by consumers. Typically, outward shifts in demand will lead to an increase in both the equilibrium price and quantity due to movement along an upward sloping supply curve. Inward shifts of demand will have the opposite effect (a decrease in equilibrium quantity and price). Outward shifts in supply (along a downward sloping demand curve) will lead to an increase in equilibrium quantity and a reduction in equilibrium price.

You can experiment with these changes in the interactive below:

To see the effects of specific exogenous shocks on the demand-side or the supply-side of the market, click on one of the following:

|

|