The Permanent Income Hypothesis (PIH) attempts to explain consumption behavior and expected relationships in cross-sectional and longitudinal APC's by first redefining measures of income.

Observed values of aggregate income 'Y' can be divided up into two separate components: 'YP' Permanent (or projected levels of) Income and 'YT ' Transitory (or unexpected changes in) Income. Thus:

Y = YP + YT.

The transitory component has an expected value of zero (E[YTt] = 0) reflecting the notion that over time transitory gains are offset by future transitory losses and vice-versa. Thus in the long run observed levels of income 'Y' are equal to permanent income 'YP'.

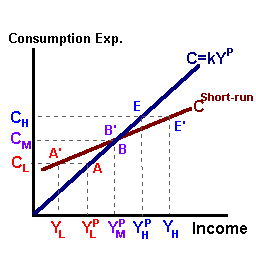

Finally, according to the PIH consumption expenditure is proportional to permanent income:

C = kYP

such that the parameter 'k', a constant, represents both the average propensity to consume and the marginal propensity to consume. This consumption function (as shown with the blue line below) is described more accurately as a long run consumption function consistent with the observed long run results of consumption behavior.

Observed short run behavior is explained through the value of transitory income for different income groups. Specifically, transitory income for low income groups is assumed to be negative reflecting the notion that over time transitory losses exceed transitory gains for this group of individuals:

YTL < 0 → YL < YPL

For middle income groups the value of transitory income is equal to zero over time such that observed and permanent income take the same value:

YTM = 0 → YM = YPM

Finally, for high income groups, transitory gains exceed transitory losses such that transitory income is on average positive over time or:

YTH > 0 → YH > YPH

The impact of this transitory component can be used to develop a short run consumption function (the red line) as shown in the diagram.

The PIH provides a framework for understanding how households will likely react to changes in income in making near-term consumption spending decisions. If the changes in income are perceived to be transitory, consumption spending may be unaffected -- transitory gains will be saved to meet the demands of transitory losses sometime in the future. Changes in income that are perceived to be permanent can have a real and immediate impact on consumption spending.